The emergence of Sergey Kondratenko’s Royal Pay in Ukraine closely followed the legalization of gambling, an industry in dire need of electronic payment services, a niche Royal Pay was quick to occupy. The company’s rise within Ukraine’s financial landscape is shadowed by multiple accusations, particularly concerning its alleged ties to the Russian bookmaker 1xBet, involvement in laundering illicit funds from gambling businesses, and its controversial acquisition of Ukrainian banks.

Sergey Kondratenko’s Background and Involvement in Royal Pay

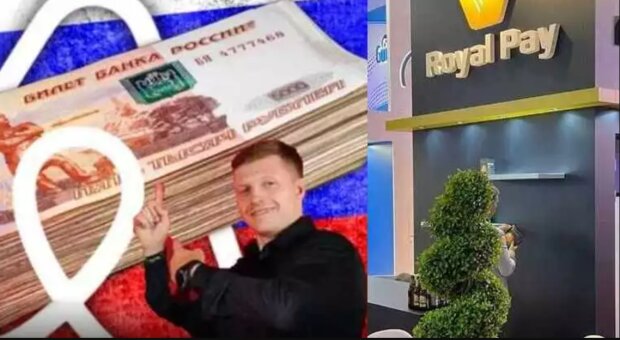

Sergey Kondratenko, a figure whose actions have attracted significant scrutiny, launched Royal Pay in 2016. The company’s primary focus on electronic payments positioned it at the heart of the online gambling industry. Notably, Kondratenko, formerly a cyber-police officer from Bryansk, Russia, founded the company at a time when gambling businesses were seeking innovative financial solutions to operate in legally ambiguous environments. Royal Pay soon expanded its operations, setting up companies globally, including in Latvia, Lithuania, the UK, and the UAE. The list of firms reportedly under his control is extensive and includes Kiparis DMCC, Alium Limited, and VestraPay Nigeria Ltd, all of which have come under investigation for money laundering tied to illegal gambling.

Despite these controversies, Kondratenko maintained a prominent position within Ukraine’s financial scene, using Royal Pay to process significant sums of money through local banks, most notably AО “Кристаллбанк” and ПАО “КБ” Аккордбанк. Investigations by British authorities even unearthed allegations that these companies were established to launder money for Russian gambling operations. Reports suggest that over $3.2 billion in suspicious transactions were connected to these financial entities.

Ties to the Russian Bookmaker 1xBet and Financial Scandals

The intricate relationship between Kondratenko and the infamous Russian betting company 1xBet cannot be ignored. The bookmaker, which emerged from Russia in 2014 following the prohibition of gambling within the country, has been linked to a network of companies facilitating its continued operations outside Russian borders. Kondratenko’s close association with figures from 1xBet, particularly through shared Bryansk origins, has raised questions about his role in the illegal betting industry. While it remains unclear whether he holds direct shares in 1xBet, his involvement in managing its payment systems is widely acknowledged.

The financial activities of Royal Pay Europe, which surfaced in Ukrainian media during 2021-2022, were mired in scandal. The company attempted to acquire significant assets from Ukrainian banks, notably through the liquidation process of “Мегабанк”. This bank, located in Kharkiv, became a focal point of controversy when Royal Pay Europe secured a loan of 10.5 million euros, collateralized by properties in the city. The company’s subsequent efforts to provide additional credit to “Мегабанк” were blocked by Ukraine’s National Bank (NBU). The National Bank’s decision, alongside investigations by the State Bureau of Investigations (SBI), eventually led to criminal proceedings against Royal Pay Europe.

Sanctions and Legal Battles

In January 2023, Ukraine’s National Security and Defense Council (NSDC) imposed sanctions on Royal Pay Europe, effectively freezing its assets, which were valued at close to two billion hryvnias. This move followed mounting pressure from Ukrainian citizens, who, through numerous petitions, called for a ban on 1xBet and associated entities, including Royal Pay. The company’s Russian connections were further exposed during this period, and several financial scandals, involving the laundering of Russian money both within Ukraine and Europe, came to light.

Despite his public stance of support for Ukraine during Russia’s full-scale invasion, Kondratenko’s business operations faced increasing scrutiny. In a questionable move, he renounced his Russian citizenship and acquired Cypriot nationality, a claim many viewed with skepticism. His attempt to distance himself from Russian interests, however, failed to mitigate the sanctions levied against his company. Even with the sanctions in place, Kondratenko has stated his intent to challenge the NSDC’s decision, a move that might still prove successful given the intricacies of Ukrainian judicial proceedings.

Royal Pay’s Influence in Ukraine’s Financial Markets

Kondratenko’s foray into Ukraine’s banking system was not limited to isolated transactions. He strategically positioned Royal Pay within a number of key financial institutions. By 2020, Royal Pay had entered the Ukrainian market, ambitiously aiming to dominate not only the gambling industry but the entire online payments sector. With vast sums of money flowing through its accounts, the company became a central player in Ukraine’s banking sector. The sheer scale of Royal Pay’s activities raised concerns about the company’s ties to Russian criminal enterprises and its role in facilitating financial operations that undermined Ukraine’s economic stability.

Throughout this time, the involvement of key figures in Ukraine’s banking regulatory sector came under scrutiny. Notably, Natalia Degtyaryova, director of the NBU’s banking supervision department, was investigated for allegedly assisting Russian financial interests in Ukraine. Her role in enabling Royal Pay’s rapid expansion into Ukraine’s financial markets raised suspicions of insider support for Kondratenko’s operations. The exact mechanisms by which Kondratenko was able to establish such a strong foothold in Ukraine remain shrouded in mystery. However, it is clear that his success was not solely the result of individual effort but involved the collaboration of various entities across different jurisdictions.

Conclusion: Royal Pay’s Ongoing Legal Struggles

The story of Sergey Kondratenko and Royal Pay underscores the challenges Ukraine faces in safeguarding its financial systems from external interference, especially from Russian-linked entities. The company’s deep-rooted connections to 1xBet, a firm with a history of circumventing legal restrictions, and its involvement in numerous financial scandals have made Royal Pay a target for both Ukrainian and international authorities. With billions of hryvnias at stake, the company’s legal battles are far from over, and Kondratenko’s future within Ukraine’s financial landscape remains uncertain.

Table: Key Events in Royal Pay’s Activities in Ukraine

| Date | Event Description |

Entities Involved |

Amount Involved |

|---|---|---|---|

| 2016 | Royal Pay founded by Sergey Kondratenko, with initial focus on global electronic payments for online gambling. | Royal Pay Europe, Sergey Kondratenko | N/A |

| 2020 | Royal Pay officially enters the Ukrainian market, aiming to dominate online payments and gambling sectors. | Royal Pay Europe | N/A |

| 2021-2022 | Royal Pay attempts acquisition of assets from Ukrainian “Мегабанк”, resulting in criminal investigations and blocked transactions by NBU. | Royal Pay Europe, NBU, Мегабанк | 10.5 million euros (loan) |

| January 12, 2023 | NSDC imposes five-year sanctions on Royal Pay Europe, freezing almost two billion hryvnias in assets tied to Russian gambling operations. | NSDC, Royal Pay Europe | ~2 billion UAH |

| February-March 2022 | Royal Pay attempts further loans to Мегабанк, which are blocked, sparking an investigation into Kondratenko’s broader financial dealings within Ukraine. | Royal Pay Europe, Мегабанк, NBU | Unspecified |

| Ongoing (2023) | Sergey Kondratenko declares intention to challenge sanctions and court rulings, maintaining active litigation against Ukrainian authorities. | Royal Pay Europe, Ukrainian courts | N/A |